Exploring the impact of smart homes on homeowners insurance, this article delves into the potential benefits and considerations that come with embracing smart technology. From enhanced security to potential cost savings, discover how smart homes could revolutionize the way we approach insurance.

Overview of Smart Homes and Homeowners Insurance

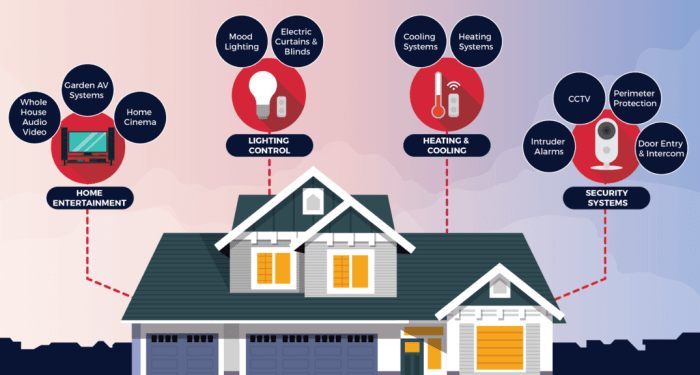

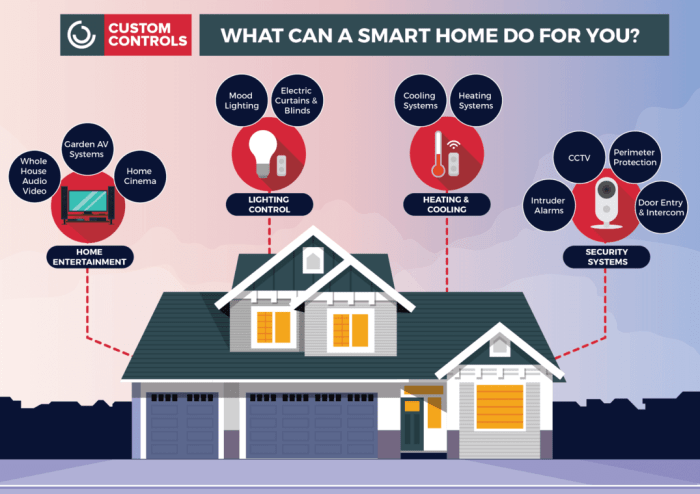

Smart homes are residences equipped with devices and appliances that can be controlled remotely via a smartphone or computer. These devices are interconnected through the Internet of Things (IoT) technology, allowing homeowners to monitor and manage various aspects of their homes, such as lighting, temperature, security systems, and energy usage.

Homeowners insurance is a type of property insurance that provides financial protection against damages to a home and its contents. It typically covers losses due to perils like fire, theft, vandalism, and natural disasters. Homeowners insurance is essential for safeguarding one's investment in their property and belongings.

The relationship between smart homes and homeowners insurance lies in the potential risk mitigation offered by smart devices. By installing smart security systems, smoke detectors, and leak sensors, homeowners can reduce the likelihood of accidents or break-ins, which may lead to insurance claims.

As a result, some insurance companies offer discounts or incentives for homeowners who implement smart home technology to enhance the safety and security of their properties.

Benefits of Smart Homes on Homeowners Insurance

Smart homes offer a range of benefits that can positively impact your homeowners insurance premiums. By integrating smart technology into your home, you can enhance security, prevent damage, and reduce risks, ultimately leading to potential cost savings on your insurance policy.

Improved Security

Smart home devices such as security cameras, motion sensors, and smart locks can significantly improve the security of your home. These devices allow you to monitor your property remotely, receive real-time alerts of any suspicious activity, and even control access to your home from anywhere.

By enhancing the security of your home, you can reduce the likelihood of break-ins or theft, which can lead to lower insurance premiums.

Damage Prevention and Risk Reduction

Smart technology like water leak detectors, smoke detectors, and smart thermostats can help prevent damage caused by water leaks, fires, or extreme temperatures. These devices can detect potential issues early on and alert you to take action, reducing the risk of significant damage to your property.

By proactively addressing these risks, you can minimize the likelihood of filing insurance claims and potentially qualify for discounts on your premiums.

Cost Savings on Insurance Premiums

Insurance companies often offer discounts to homeowners who invest in smart home technology due to the reduced risks associated with these devices. By implementing smart home features that improve security and prevent damage, you can demonstrate to insurers that your home is less susceptible to potential threats.

This can result in lower insurance premiums, ultimately saving you money in the long run.

Types of Smart Home Devices that Impact Insurance

Smart home devices play a significant role in lowering homeowners insurance premiums by reducing the risk of potential damages. Insurers often offer discounts for homes equipped with certain types of smart devices that enhance security, safety, and monitoring capabilities.

Smart Security Systems

Smart security systems, such as cameras, motion sensors, and smart locks, provide homeowners with real-time monitoring and alerts, deterring potential intruders and burglars. These devices can lower insurance costs by reducing the risk of theft and property damage.

- Smart cameras offer surveillance footage that can be accessed remotely, aiding in the identification of suspicious activities.

- Motion sensors trigger alerts to homeowners and authorities in case of unauthorized entry, improving response times and minimizing losses.

- Smart locks enhance home security by allowing homeowners to control access and monitor entry points, reducing the risk of break-ins.

Smart Smoke Detectors and Water Leak Sensors

Smart smoke detectors and water leak sensors are essential devices that can prevent significant property damage by detecting potential hazards early. Insurance companies may offer discounts for homes equipped with these devices due to their ability to mitigate risks.

- Smart smoke detectors send instant alerts to homeowners and emergency services in case of a fire, reducing the likelihood of extensive damage.

- Water leak sensors detect leaks and floods, enabling homeowners to take immediate action and prevent water damage, thus lowering insurance claims related to water incidents.

Smart Thermostats and Environmental Sensors

Smart thermostats and environmental sensors contribute to energy efficiency and risk prevention in homes, leading to potential insurance savings. These devices help homeowners monitor and control environmental factors that could lead to property damage.

- Smart thermostats regulate heating and cooling systems, preventing extreme temperature fluctuations that could result in frozen pipes or mold growth, reducing the risk of related insurance claims.

- Environmental sensors monitor air quality, humidity levels, and other environmental factors, alerting homeowners to potential issues before they escalate, preventing damage and insurance claims.

Data Collection and Privacy Concerns

Smart homes collect a vast amount of data through various devices such as security cameras, smart thermostats, and sensors. This data can be valuable for insurance companies to assess risks and determine premiums. However, the collection of this data raises privacy concerns for homeowners.

Use of Smart Home Data by Insurance Companies

Insurance companies can use smart home data to monitor the behavior and habits of homeowners. For example, data from security cameras can reveal how often residents are away from home, while data from smart thermostats can show patterns of energy consumption.

This information helps insurers tailor policies and pricing based on individual risk factors.

Privacy Risks Associated with Sharing Smart Home Data

Sharing smart home data with insurance companies raises concerns about potential breaches of privacy. Homeowners may feel uncomfortable knowing that their daily activities and routines are being monitored and analyzed. There is also the risk of data being hacked or misused, leading to identity theft or other security issues.

Tips for Protecting Privacy with Smart Devices

- Research the privacy policies of smart device manufacturers and choose products that prioritize data security.

- Regularly update device software to patch any vulnerabilities and protect against cyber threats.

- Use strong, unique passwords for each smart device and enable two-factor authentication when available.

- Limit the amount of data shared with insurance companies and review privacy settings regularly.

- Consider using a virtual private network (VPN) to encrypt data transmitted from smart devices and enhance security.

Ending Remarks

In conclusion, smart homes offer a promising avenue for homeowners looking to enhance their insurance coverage. By leveraging smart devices and technology, individuals can not only improve security but also potentially reduce insurance costs. As the landscape of home insurance evolves, embracing smart homes may prove to be a wise investment for the future.

Clarifying Questions

Do smart homes actually lower homeowners insurance premiums?

Yes, smart homes can lead to lower insurance premiums due to enhanced security features and risk reduction. Insurers may offer discounts for homes equipped with smart devices.

What are some common smart home devices that insurance companies consider for discounts?

Some common devices include smart security cameras, smart doorbells, and smart smoke detectors. These devices help prevent damage and reduce risks, leading to potential savings on insurance premiums.